Though there are many reasons a homeowner might opt to refinance, the most common reasons for refinancing a mortgage are to lower the interest rate and to lower the monthly payments. A homeowner’s needs may change as their financial situation changes, meaning the mortgage terms you chose a year or two ago may not be the mortgage terms you want today. With today’s historically low rates, now is a good time to begin considering refinancing your mortgage with Assurance Financial.

What Does It Mean to Refinance?

When it comes to mortgages, you may have heard the term refinancing. But what does it actually mean to refinance your home?

Refinancing your mortgage essentially means acquiring a new mortgage to replace your existing mortgage. This new loan pays off the remainder of your existing mortgage, and then you become responsible for paying off your new loan. As with your existing mortgage, this new mortgage will also require application fees, a title search and an appraisal.

But how do you know if you should refinance your mortgage? Is it smart to refinance your mortgage? If it is the right decision for you, how do you go about refinancing, and what do you need to refinance your home? First, define your financial goals. Once you know what you hope to accomplish, then consider your refinancing options.

The Types of Refinance Mortgages

The three refinance mortgages you can choose from are known as rate-and-term, cash-out and cash-in.

1. Rate-and-Term

The most common refinance option is rate-and-term. This means that the term or rate of your loan, or possibly both, are different from your original mortgage. The term of your loan may change from a 30-year fixed rate to a 15-year fixed rate. Or maybe you’ll refinance from a 30-year mortgage at a 5 percent interest rate to a 30-year mortgage at a 4 percent interest rate. This could result in major savings in the long run.

2. Cash-Out

This refinance option means the homeowner refinances for a loan of a greater amount than their current loan. The homeowner receives the difference. So if you start with an amount of $100,000 owed on your current mortgage and you refinance for a loan of $120,000, you will receive $20,000 cash out. Banks typically see this refinance option as riskier, but when used responsibly, it can be an effective strategy for homeowners who want to pay off high-interest debt or build equity in their homes.

3. Cash-In

The opposite of a cash-out refinance mortgage is a cash-in refinance. Rather than getting cash in return, homeowners put cash toward paying down their loan balance. This can help homeowners access lower mortgage rates that are typically available only for lower loans or to eliminate mortgage insurance premiums, saving homeowners money.

The type of refinance mortgage you choose will depend on your individual financial situation and your goals.

So how do you know if refinancing your mortgage is right for you?

Signs It’s Time to Refinance

When you’ve first signed your mortgage, it may feel like everything is set in stone, but for homeowners, this is far from the truth. The decision to refinance your mortgage gives you the option to save on interest, take some time off your loan term, or cash out on your equity. If refinancing will lower the amount of interest you’ll pay on your mortgage, then you may find this to be an option worth exploring. Not sure refinancing your mortgage is the right financial move for you? Here are a few signs refinancing may be the right next step for you.

1. A Lower Interest Rate is Possible

Mortgage interest rates fluctuate constantly. Several factors impact interest rates, such as the monetary policy of the U.S. Federal Reserve, inflation, the economy and market. If the rates are currently lower than what you are paying, you may want to consider refinancing.

Replacing your mortgage for one that comes with a lower interest rate at the same remaining term is called rate-and-term financing. What decrease in rate is enough to consider refinancing? Generally, if you can get a rate that is at least one to two percent less than your existing rate, you can consider refinancing your mortgage. No rule of thumb can apply to all individuals and circumstances, however. While a one percent rate of interest may result in a large amount of savings for someone with a million-dollar mortgage, the same may not be true for someone with a mortgage that’s only $100,000.

You may even consider refinancing when the percentage saved is less than one percent. Though conventional advice calls for at least a one percent reduction, this rule of thumb is a holdover from the 50s, when loans were smaller, and homeowners continued to live in their homes until death. Today, with much larger loan sizes, a smaller percentage reduction can still result in significant savings.

Take the time to check the updated interest rate and compare it to your initial rate. Remember, your credit score determines your individual interest rate, meaning a lower rate isn’t always promised.

2. Your Credit Score Has Improved

If you’ve been working on rebuilding your credit, refinancing could benefit you. Generally, the higher your credit score, the lower your interest rate. Keep in mind, individual lenders determine the worth of your credit score, so individuals with a score that falls above 700 typically receive the lowest rates, but it is possible for you to get a great deal even if your score is between 600 and 700.

With a loan savings calculator, you can determine your APR, monthly payment and total interest depending on your credit score, type of loan, principal loan amount and your state of residence. A 30-year fixed loan for a principal amount of $100,000 at a credit score of 620 to 639 would give you an approximate APR of 5.006 percent. This adds up to a monthly payment of $537 and a total interest amount of a whopping $93,388.

What would happen if you increased your credit score to the 760 to 850 range? Your APR would drop to 3.417 percent, your monthly payment would drop to $444, and your total interest paid would be only $59,993. That’s a difference of $33,395 simply based on credit score.

One of the most important factors that mortgage lenders take into consideration is your credit history. Even a mere one point increase in your credit score can reduce mortgage fees. Fortunately, there are plenty of methods to increase your credit score to ensure you get a great mortgage interest rate:

- Request a rapid rescore.

- A rescore can purge any errors that are hurting your credit score, potentially boosting your score from a few points to 100 points in a matter of days. Mortgage lenders can use this method to help borrowers increase their credit scores.

- Request credit reports. You can request one free credit report a year from three major bureaus –– Equifax, Experian and TransUnion. Report any errors you find as soon as possible. If you’re focusing on improving your credit score over several months, request a free credit report every four months from one of the three bureaus so you can track how your credit score is improving.

- Pay your bills on time. Your past and present payment performance are considered to be a reliable indicator of your future payment performance to lenders. Paying late or missing payments is a quick way to harm your credit score, so be certain you’re making consistent, on-time payments. Use automated payments to ensure you don’t forget to pay any of your bills.

- Improve your debt-to-income ratio. You can increase your credit score when you pay off debt and keep your credit card balances low. The general recommendation is to keep your credit use at 30 percent –– meaning you use under 30 percent of your credit line. If your credit limit is $2,000, that means you shouldn’t charge over $600.

- Keep unused credit cards open. By not closing unused credit cards that aren’t costing you any annual fees, you can retain your credit mix and credit history and keep your use ratio low.

If your credit score has improved and you think you may qualify for a lower interest rate on your mortgage, you may want to consider refinancing. If you decide refinancing may be a viable option for you, be sure to perform the calculations yourself, as mortgage rates fluctuate and may drop even lower.

3. You’ve Seen a Jump in Income

An increase in income can be great if you’re looking to refinance to a shorter loan term. Going from a 30-year mortgage to a 15-year term can save you thousands of dollars in interest.

As in the example above, a 30-year fixed loan of $100,000 at a high credit score of 760 to 850 would result in a monthly payment of $444 and a total interest amount of $59,993 at an APR of 2.845 percent. If you reduce your loan term to 15 years, however, the APR on the same amount of loan principal and at the same credit score changes to 2.845 percent, and the total interest amount drops to $22,967 –– a difference of $37,026. That’s an even bigger jump in savings than by improving your credit score.

A caveat of the 15-year loan term, though, is your monthly payment increases. At a 30-year term, your monthly payment is $444. However, with a 15-year term, your monthly payment is $683. If your budget can comfortably accommodate an additional $239 a month, then this may be an excellent option for you. But if the increased monthly payment makes your budget uncomfortably tighter, you may want to consider sticking with your 30-year loan term.

With a 15-year fixed loan term, you may pay more toward your mortgage each month, but you’ll also see huge savings in the amount of interest you pay over the term of your loan. High-income earners or those with enough wiggle room in their budget may want to opt for the shorter loan term.

4. You Have Concerns About Your ARM Adjusting

Adjustable rate mortgages (ARMs) vary over the life of the loan. The rates depend on not only market conditions, but also the type of loan you have. Some ARMs adjust once a year, while others adjust after five or seven years. In most cases, you’ll pay less interest with an adjustable rate mortgage and have lower monthly payments early in your loan term.

If your existing mortgage is at a fixed-rate and you anticipate that interest rates will continue falling, you might consider switching to an adjustable rate mortgage. If you plan to move within a few years, changing to an ARM may make the most sense for your situation since you won’t be in your home long enough to see the loan’s interest rate rise.

Alternatively, the most unsettling thing about ARMs is when it’s time for the loan to adjust, interest rates and payments may skyrocket. Refinancing and switching over to a fixed rate mortgage may be a good option for you if you’re worried you won’t be able to afford your payments when your loan adjusts.

5. The Value of Your Home Has Increased

Since 2011, the values of homes has risen from an average of $250,000 to an average of $394,000. Yet many homeowners don’t refinance their mortgages when the value of their home increases. If your home’s value has increased, refinancing may be a beneficial option for you. If you’re looking quickly to pay off other high-interest debts or fund major purchases, this avenue may be even more appealing.

Cash-out refinancing is a financing option that allows you to acquire a new, larger mortgage so you can receive the difference in cash between your new mortgage and your previous mortgage. For example, maybe your house was originally valued at $250,000. You put 20 percent toward a downpayment –– $50,000.

Your mortgage of $200,000 is now $140,000 after a few years of payments, but now your house has increased in value from $250,000 to $300,000. You may now opt to refinance your mortgage for more than your remaining balance of $140,000. If you refinance for $165,000, you can use that $25,000 difference to pay off high-interest debt, make home improvements or fund major purchases.

If you’re in a financial situation in which you know you can comfortably pay back that additional $25,000 of mortgage debt, this may be the right move for you. If you’re thinking you may use this cash to pay off other high-interest debt, be sure to calculate whether you’ll end up paying more interest for that debt than for your mortgage. If you’ll ultimately pay more interest for other high-interest debts, then cash-out refinancing may be a great choice for you. If you’ll pay more in mortgage interest, you may want to stick with your existing mortgage.

Be sure to check the value of your property so you can have an accurate estimate before refinancing your mortgage. Over or underestimating your home’s value may result in you overpaying and saving less.

If any of these five signs apply to you, it may be time to consider refinancing your mortgage.

What Is the Refinancing Process?

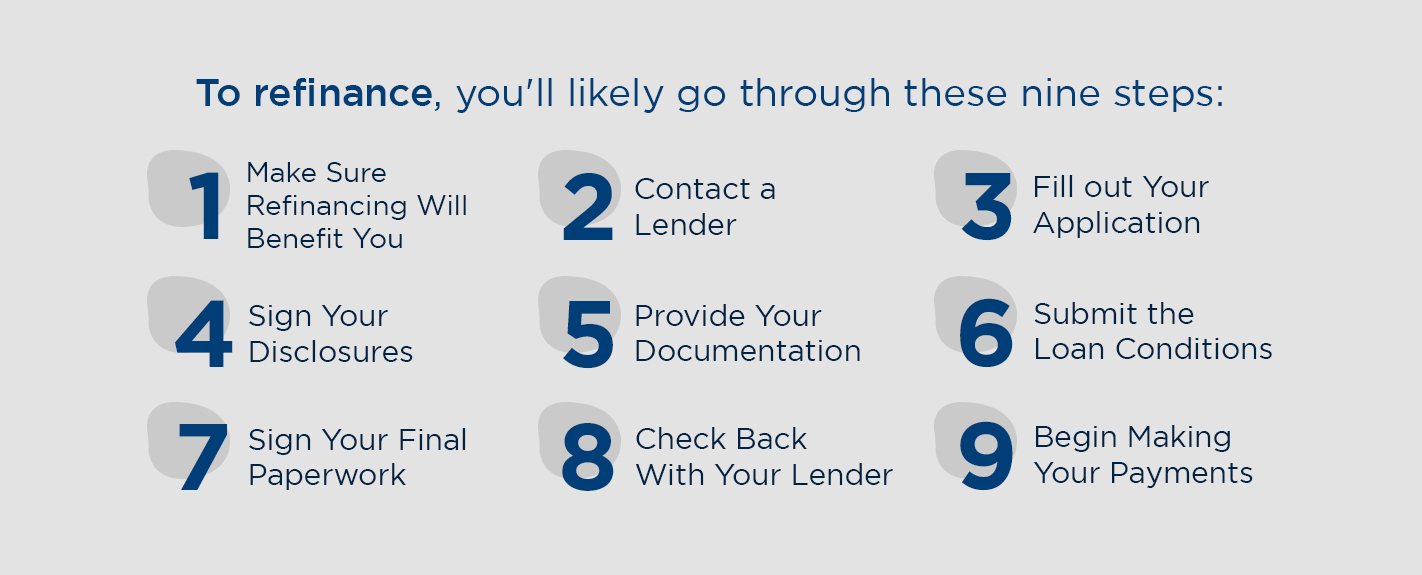

Whether you’re refinancing to lower your monthly payments, to lower your interest rate or to free up some cash to pay off high-interest debt or build equity in your home, you’ll probably want to know what you can expect from the process of refinancing a mortgage before jumping right in. To refinance, you’ll likely go through these nine steps:

1. Make Sure Refinancing Will Benefit You

Your first step in refinancing your mortgage is making sure that refinancing will be beneficial for you. Know what your goal is and determine whether you can attain it. Are current rates low enough for you? Will you ultimately be saving money? If you cash out, make sure having that money right now will outweigh the extra years spent in debt. Everyone’s financial situation and priorities are different, so only you can decide what the best decision is for you.

2. Contact a Lender

With Assurance Financial, we want to make your refinancing process as quick and painless as possible. We offer the chance to get pre-qualified in just 15 minutes, with a no obligation quote and a free rate quote. You can apply online or with one of our experts licensed across the country. We have every type of loan available, and because we’re an independent lender, we won’t pass around your loan or data to anyone else like other mortgage brokers. With no obligation, we can check your credit, provide you with a rate quote and send you the numbers.

3. Fill out Your Application

Once you are ready to refinance, you can begin your application with us.

4. Sign Your Disclosures

We’ll send you the initial disclosures for you to sign and you may also take this opportunity to verify the loan terms and ensure you’re accomplishing your goal of either lowering your rate or cashing out.

5. Provide Your Documentation

After signing, you’ll then provide your documentation to us, such as asset verification and income.

6. Submit the Loan Conditions

We’ll then send your paperwork to one of our in-house underwriters who will let us know if any additional items are needed.

7. Sign Your Final Paperwork

After approval, you’ll sign with a notary.

8. Check Back With Your Lender

After three days, during which you can cancel your refinance for no cost, your loan will be funded. At this point, your previous mortgage will be fully paid.

9. Begin Making Your Payments

Now you’re done with the refinancing process! You can start making the payments on your new mortgage, which will be due in 30 to 60 days after the funding process.

Refinancing a mortgage can seem overwhelming at the start, but it doesn’t have to be. With Assurance Financial, we strive to make your journey to refinancing as quick and simple as possible.

Refinancing With Assurance Financial

Refinancing your mortgage may be a smart move if you’re still in the early years of your mortgage and can get a lower interest rate by refinancing.

If you want to save money, refinancing your mortgage may be the right move for you.

You can refinance with us today at Assurance Financial. For most Americans, the American Dream includes homeownership. We want you to own the house of your dreams –– with the mortgage terms of your dreams. You can apply with us and get instant verification by signing into your bank accounts and payroll platforms, so there’s no need to fax any statements.

To get a mortgage, you need a licensed loan officer on your side, and we’re here to help. We use the latest in application technology to make starting the loan process fast and simple, and we offer the service you need for end-to-end processing all under one roof.

Curious how we have an average 4.98 star-rating across thousands of reviews? Discover why we’re one of the best lenders for your mortgage refinance today. Find a loan officer near you with us at Assurance Financial for more information on refinancing.